ACT Tax Facts: By Standing Still on Taxes, the U.S. Has Fallen Behind the Rest of the World

We all have seen the chart where we used to have the lowest corporate tax rate in the world and now we have the highest. By standing still we have fallen behind. And everybody says, quite rightly, why the heck are we in that position?‚ Martin A. Sullivan, Tax Analysts, Speaking on January 29, 2014 at the American Enterprise Institute

Congress last reformed the U.S. tax code in 1986. The world has changed dramatically since then, and other countries are modernizing their tax systems as a result. As these nations adapt to attract business investments and encourage economic growth, the U.S. is losing out. With our high corporate income tax rate that is out of step with the rest of the world and a dysfunctional system of international corporate taxation, our economic growth is hindered. American workers and their employers are stuck at a significant disadvantage relative to global competitors.

Corporate Income Tax Rate

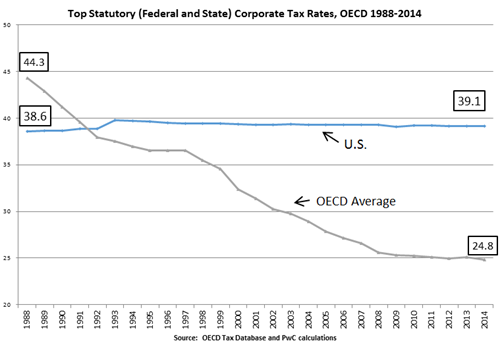

In 1988, as a result of the bipartisan Tax Reform Act of 1986, the top U.S. federal corporate income tax rate was cut to 34 percent federal plus 4.6 percent average state rate. This total state and federal income tax rate of 38.6 percent was well below the average 44.3 percent rate for other OECD countries. Since then, the average for other OECD countries has fallen 19.5 percentage points to 24.8 percent, leaving the U.S. with the highest corporate tax rate of the 34 OECD member countries.

The high U.S. corporate statutory rate also leads to the U.S. corporate effective tax rate being higher than those in other countries, as noted in a comprehensive review of 13 studies of cross-country corporate effective rates by the Tax Foundation. This review finds that the U.S. corporate effective tax rate was an average of 7.6 percentage points higher than the average of all other nations between 2005 and 2011.

How did the U.S. fall so far behind? A look at the U.K., Canada and Japan shows:

- In the past four years, the U.K. has lowered its corporate tax rate seven percentage points to 21 percent. Effective April 1, 2015, the corporate tax rate will be reduced to 20 percent.

- Canada has lowered its combined corporate tax rate from 42.4 percent to 26.3 percent since 2000, according to OECD data.

- Japan, has lowered its combined national and local corporate tax rate from 39.5 percent in 2011 to 34.6 percent in 2014, according to OECD data. Additionally, the cabinet has approved phasing down the rate to below 30 percent over several years.

There's no question that the competitiveness of the United States as a location for investment and corporate headquarters is being diminished by the more competitive corporate tax systems abroad. Mieko Nakabayashi, Member of the Japanese House of Representatives, noted that With most of the world Japan included cutting corporate tax rates and employing territorial tax systems to remain competitive, the U.S. must surely know that its hesitancy to do these things is handing the advantage to its international competitors. They will suffer from that hesitancy while we and others outside the U.S. will benefit.

British Finance Minister George Osborne highlighted the competitiveness rationale for lowering the U.K. corporate tax rate, saying. For we live in a world where the competition for business is growing ever more intense. I want a sign to go up, over the British economy, that says Open for Business. And this is how I propose to do it. Corporation tax rates are compared around the world, and low rates act as adverts for the countries that introduce them.

System of International Taxation

The United States has also fallen behind by holding fast to a worldwide system of international taxation long after other modern industrialized economies have moved on. According to a 2013 report, 28 of 34 OECD member companies and all G7 countries except the United States have adopted a more modern territorial system, with half of these countries adopting territorial tax systems within the last 15 years. According to a report by Business Roundtable, 93% of the non-U.S. based OECD companies in the global Fortune 500 reside in countries with territorial tax systems, putting U.S. multinationals at a distinct competitive disadvantage.

Once again, other countries have recognized this trend and moved to keep their economies competitive.

- In 2009, the U.K. replaced their worldwide tax system, which was similar to the U.S. system, with a territorial plan. A Tax Foundation report notes, Within days of the announcement, two of the twenty-two recently inverted companies announced that they would consider a move back to the U.K. Additionally, academic researchers have found that in response to the territorial system, U.K. parents of foreign affiliates increased repatriations of foreign earnings and reduced foreign affiliate investment.

- Japan has had a similar experience after adopting a territorial system in 2009. Since that time, unemployment has dropped and wages have risen all while corporate tax revenues remained steady. Additionally, academic research estimates that cross-border mergers and acquisitions with a Japanese acquirer will increase 31.9 percent as a result of adoption of a territorial system.

- Since 1986, only two countries have switched from territorial to worldwide tax systems Finland and New Zealand and both later re-adopted territorial-style systems.

According to a recent report from the Berkeley Research Group, transitioning to a territorial system could lead to $1 trillion in repatriated funds in the short term, creating a one-time increase in U.S. GDP of $208 billion and creating 1.46 million American jobs. In the long run, a territorial system would lead to an increase in U.S. GDP of $22 billion per year and create at least 154,000 new U.S. jobs per year.

A Broken Tax Code

Even as Japan, the U.K., New Zealand, Finland, Canada and other countries have modernized and improved their tax codes, the U.S. has stood still. The U.S. is currently stuck with a tax code so burdensome that U.S. companies involved in cross-border mergers with smaller foreign partners frequently are choosing to move their tax home out of the United States. Make no mistake: the environment that exists today is a symptom of how anticompetitive our tax code has become in its old age.

There is an ongoing global competition for leading businesses and economic growth. Until we tackle tax reform, the United States is playing at a significant disadvantage.

It's time for the U.S. to apply the lessons we and countries across the globe have learned since 1986 and reform the tax code to reinvigorate our economy.